GE Aviation, which primarily makes military and commercial engines, will become the main focus of the GE conglomerate after it spins off its health care and energy businesses, the Boston, Mass.-based company announced Nov. 9.

Three new companies will result from the action: GE Aviation, focused on military and commercial engines; GE Healthcare, focusing on advanced diagnostic gear and patient data; and GE Renewable Energy and Power. The moves will take effect by early 2024.

According to a company press release, “Following these transactions, GE will be an aviation-focused company shaping the future of flight.” The company doesn’t expect any regulatory or labor issues attending the split, and GE said there was no investor pressure behind the move.

In a statement, CEO H. Lawrence Culp Jr. said that “by creating three industry-leading, global public companies, each can benefit from greater focus, tailored capital allocation, and strategic flexibility to drive long-term growth and value.” The move was spurred by a desire to focus and simplify its businesses, reduce debt, and improve share price.

Culp will initially head the GE health care company as “non-executive chairman … upon its spin-off. He will continue to serve as chairman and CEO of GE until the second spin-off, at which point he will lead the GE Aviation-focused company going forward.”

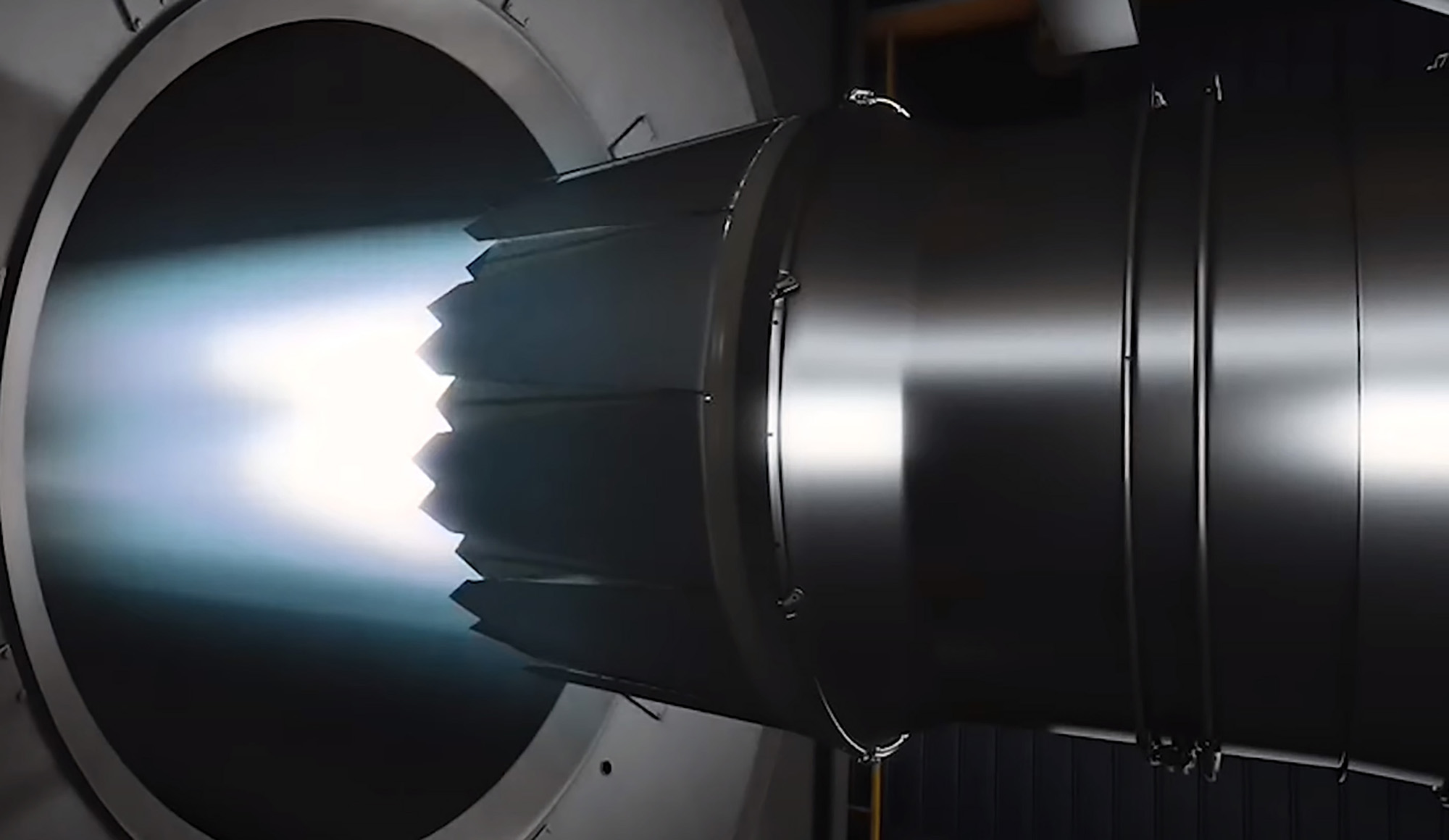

The company said GE Aviation’s focus will be “helping customers achieve greater efficiency and sustainability, and [to] invent the future of flight.” It aims to offer “global leadership in propulsion and systems with the most competitive and innovative engine value.” GE has the “youngest and largest commercial fleet and most diversified services portfolio” and “powers 2/3 of commercial flights.”

Stock analysts value GE Aviation at anywhere from a low of $30 billion to a high of $100 billion. Culp has praised the company as the bright spot of the GE conglomerate, and leading analysts have said the bulk of GE’s value is in its aviation business.

GE’s major military business centers around the F110 engine in Air Force and export F-15s and F-16s; F404 and F414 engines in the Air Force T-7, Saab Gripen fighter, Navy F/A-18 Super Hornet and Navy EA-18G Growler; and the T408 engine in the Marine Corps CH-53K. It recently won a $1.6 billion Air Force contract to supply F110 engines for the Air Force’s F-15EX, although it’s unclear if competitor Pratt & Whitney will challenge the award.

For commercial applications, the company makes the GE90, GE9X, GP7-200, CF-6 and GEnx, the latter of which may power the next Presidential Transport. GE was not selected in the recent Air Force competition to power the re-engined B-52 bomber.

The company said it fields 37,700 commercial aircraft engines and 26,500 military aircraft engines.

GE is also working with South Korea and India on the KF-X and Tejas fighters, respectively.

Another potential avenue of future GE business is the Adaptive Engine Transition Program, which has created two versions of a future fighter engine for the U.S. Air Force and potentially the Navy. GE’s version is the XA-100, while Pratt & Whitney’s in the XA-101. The Air Force has not said whether its acquisition strategy for the Next-Generation Air Dominance fighter will call for a single engine supplier or two, on a competitive basis, but GE is also hoping to capture some of the work for future propulsion of the F-35 fighter, on which Pratt & Whitney has been the sole supplier.

While GE said it will take a one-time charge of $2 billion related to separation costs, it also said it would reduce its debt “by more than $75 billion by the end of 2021, compared with 2018.” The aviation company would carry the largest share of debt but is also the most profitable of the three.

Just 20 months ago, Pratt & Whitney became part of Raytheon when that company merged with United Technologies/Collins Aerospace. Analysts said it’s unlikely that another major defense prime would seek to merge with or buy the new standalone GE aviation before mid-decade.

GE’s stock price initially gained seven percent on the announcement, but by midday, that bump had declined to 2.18 percent, trading at $110.92 per share.