China’s dependence on Russian fighter aircraft engines may soon affect the People’s Liberation Army Air Force fleet if Russia can’t service or provide engines or parts for up to 40 percent of the Chinese fighters, experts at the China Aerospace Studies Institute conference said May 17.

China has yet to wean itself off Russian engines by mastering the technology, experts explained during a panel discussion on military cooperation between China and Russia. If Russia must resupply its own military over the course of a protracted war, that competing demand for parts could prompt China to focus more intently on building up internal expertise.

“China is still quite dependent on Russian components and probably will be for the foreseeable future,” said David R. Markov of the Institute for Defense Analysis.

Russia delivered nearly 4,000 engines for Chinese helicopters and other military aircraft between 1992 and 2019. China has also received Russian S-300 and S-400 air defense systems.

“I think they’re going to continue to buy engines from the Russians, though it’ll be interesting to see whether Russia can now supply these engines in light of the international sanctions,” Markov said, referring to economic blocks imposed by U.S. and European countries that limited Russia’s acquisition of technologies such as semiconductors, used by the Russian defense industry.

The situation gives China a much greater incentive to apply national resources to “fix the engine problem that they have,” he added.

Markov discussed China-Russia aerospace cooperation, tracing the history of Russia’s dual-use and military sales to China, including its technology transfer over the decades since the fall of the Soviet Union.

While China has made significant gains in acquiring key military technologies that helped develop its stealthy J-20 and J-31 fighters, Markov argues that, in the area of fighter engine production, China is still lagging because Russia withheld advanced secrets. China’s struggle in this area isn’t due to a lack of resources devoted to the effort but a lack of domestic expertise, he said.

Many of China’s scientists, engineers, designers, and production managers are in their late 20s and early 30s, and they lack the know-how that comes from apprenticeship programs and decades of specialized experience. To make up for that, China has contracted Russian specialists to work inside Chinese factories.

However, “This isn’t a ‘throw money at the problem’ solution,” he said.

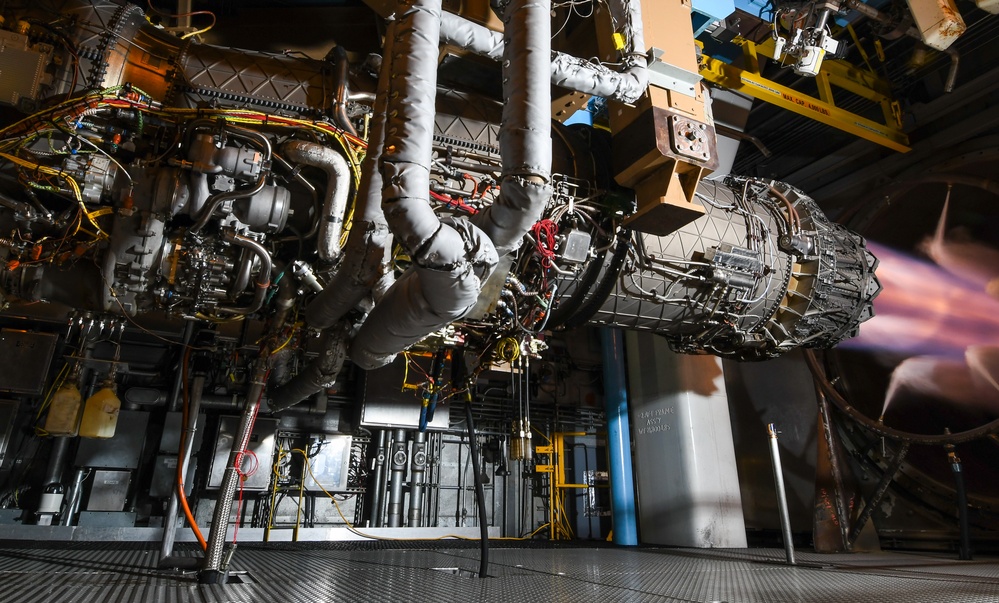

“What they still have yet to understand is, modern aviation engines, particularly supercruise fighter engines, are more art than science,” Markov explained.

Engine workers at producers such as Rolls-Royce, Pratt & Whitney, and General Electric have “tacit knowledge” that the Chinese are still lacking, he added.

“There’s a lot of phenomenology that takes place in an engine that we still do not … understand … with our qualitative computing technology,” Markov explained. “But there’s a guy named Joe who works at Cincinnati Milacron, who’s been working that thing for 30 years, [who] just knows, through experimentation, time, and experience, that you do this thing to make the engine get this outcome. And that’s the part where China just doesn’t have that capability yet.”

Markov believes China’s purchase of Su-35 aircraft from Russia was meant at least in part to get access to the type’s advanced engine and ancillary support and digital control system.

China has made strides, however, developing the WS-10 engine that powers its J-20 stealth fighter.

“The big game changer in much of this was the J-20,” Markov said. “It was the wake-up call to a lot of people following China: of how far they had come, and particularly with Russian talent.”

But China has struggled to develop its WS-15 engine that would give the J-20 supercruise capability, a defense analyst told Air Force Magazine during a sideline interview.

Russia still provides engines for up to 40 percent of China’s air force fleet, the analyst noted, posing the question: “Are they going to be able to sustain current readiness and flying operational capabilities in light of potential spare parts disruptions with this engine manufacturer?”